- SB 4 and SB 23 will increase the homestead exemption to $140,000, with an increase to $200,000 for seniors and the disabled

- Speaker Dustin Burrows and Lt. Governor Dan Patrick both praised the passage of the property tax relief legislation

- The House and Senate have also passed bills to increase the business personal property tax exemption to $125,000 and close the “disaster loophole” that was exploited by some local governments to raise property taxes

The Texas House gave initial approval to a property tax relief package on Tuesday that will raise the homestead exemption to $140,000, with the homestead exemption for senior citizens and disabled individuals increasing to $200,000.

The current homestead exemption is $100,000, with a homestead exemption of $110,000 for seniors and the disabled. The proposed increases in the homestead exemption will require an amendment to the Texas Constitution, which will be voted on in November.

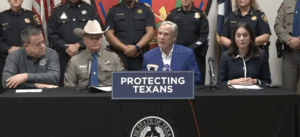

Leaders in both the Texas House and Texas Senate praised the passage of the legislation.

“Texas home & business owners are on their way to keeping more of their hard-earned money. Today, the House overwhelmingly passed legislation that delivers more meaningful property tax relief for Texans.

House members voted to increase the state’s homestead exemption from $100,000 to $140,000, while Texas seniors and those with disabilities would receive an exemption of up to $200,000.

Additionally, the Texas House raised the personal property tax exemption for businesses from the current $2,500 to $125,000—allowing business owners to reinvest their savings into the growth of their companies.

Texans will have the opportunity to vote on these measures in the election this fall,” said Texas House Speaker Dustin Burrows.

In a post on X, Lt. Governor Dan Patrick wrote, “I thank the Texas House for voting unanimously for Senate Bill 4 and Senate Bill 23 by Sen. @TeamBettencourt.

I made both property tax relief bills a high priority, as I do every session. Out-of-control property taxes were the reason I ran for Senate in 2006 and for Lt. Governor in 2014.

When I came into office as Lt. Governor in 2015, the homestead exemption was $15,000. I raised the homestead exemption to $25,000 in 2015 and then to $40,000 in 2021. Last session, we raised it to $100,000 in 2023 ($110,000 for seniors).

When the Governor signs these bills passed today into law, seniors will have a $200,000 homestead exemption. A $200,000 homestead exemption virtually wipes out all school property taxes for the average Texas senior homeowner for the rest of their lives.

Homeowners under 65 will now have a $140,000 homestead exemption, cutting their school taxes by nearly 50% or more since 2018.

I made this promise to voters many years ago. I kept my promise. There is still more to do, but today is a gigantic step toward eliminating school property taxes for millions of Texans.

I thank Speaker @Burrows4TX for his support for increasing the homestead exemption from day 1.”

Senate Bill 4, by State Senator Paul Bettencourt and State Representative Morgan Meyer, increases the homestead exemption from $100,000 to $140,000. Senate Bill 23, also by Bettencourt and Meyer, increases the additional homestead exemption for those 65 and older or disabled from $10,000 to $60,000.

Last week, the Texas Senate passed House Bill 9, which will increase the business personal property tax exemption from $2,500 to $125,000. House Bill 30, which will close the so-called “disaster loophole” that was used by some local governments to pass property tax increases that negated previous property tax relief passed by the legislature, passed both the House and Senate earlier this month.